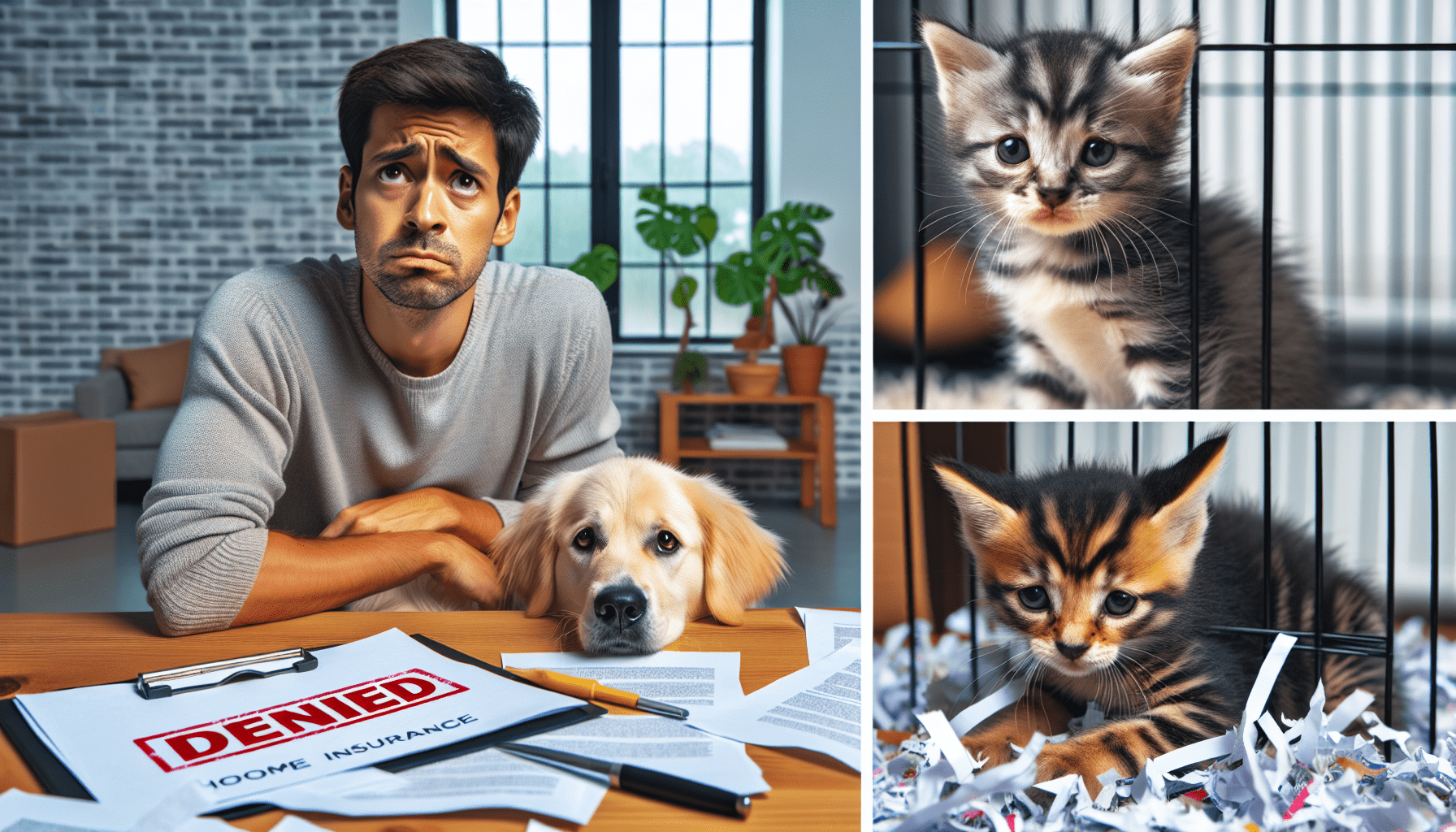

Have a furry friend? Here’s what you need to know about your home insurance!

If you have a beloved pet at home, whether it’s a loyal dog, a playful cat, or any other furry, scaly, or feathered companion, it’s essential to understand how they can impact your home insurance coverage. Pets can bring joy and companionship to your life, but they can also pose risks that may affect your insurance policy. Let’s break down the key information you need to know about pets and home insurance.

Impact of Pets on Home Insurance Coverage

Pets can impact your home insurance coverage in various ways. Insurance providers consider factors such as the type of pet you have, their breed, and their behavior when determining your policy’s terms and coverage limits. Some pets are considered higher risk due to their size, temperament, or history of aggression. For example, certain dog breeds, such as Pit Bulls or Rottweilers, are often classified as “dangerous breeds” by insurance companies.

Liability Coverage for Pet-Related Incidents

One of the primary concerns related to pets and home insurance is liability coverage for pet-related incidents. If your pet bites someone on your property or causes damages to someone else’s property, you may be held liable for the resulting expenses. In such cases, liability coverage included in your home insurance policy can help protect you financially.

Understanding Exclusions and Limitations

It’s crucial to review your home insurance policy to understand any exclusions or limitations related to pets. Some insurance policies may include specific exclusions for certain types of pets or breeds. For example, you may find that your policy doesn’t provide coverage for damages caused by exotic pets or aggressive dog breeds. Understanding these exclusions and limitations can help you assess your risks and take necessary precautions.

Tips for Pet Owners to Manage Home Insurance Costs and Risks

As a pet owner, there are proactive steps you can take to manage your home insurance costs and risks related to your furry friends. Here are some tips to help you navigate the intersection of pets and home insurance:

Train Your Pet and Maintain Control

Proper training and socialization play a crucial role in managing your pet’s behavior and minimizing risks. By training your pet effectively and ensuring they respond to commands, you can reduce the likelihood of incidents that could lead to insurance claims. Additionally, keeping your pet on a leash or in a secure area when outdoors can help prevent accidents and protect visitors to your home.

Consider Pet Liability Insurance

In some cases, it may be beneficial to consider purchasing separate pet liability insurance to supplement your home insurance policy. Pet liability insurance can provide additional coverage for pet-related incidents, such as bites, scratches, or property damage caused by your pet. Having this extra layer of protection can offer peace of mind and financial security in case of unforeseen events involving your pet.

Update Your Home Insurance Policy

When you bring a new pet into your home or if your existing pet’s circumstances change, it’s essential to update your home insurance policy accordingly. Inform your insurance provider about any new pets, changes in behavior, or training efforts that may impact your policy terms. By keeping your insurance company informed, you can ensure that your coverage aligns with your pet-related risks and needs.

Mitigate Home Hazards for Pets

To create a safe environment for your pets and reduce the risk of accidents at home, it’s important to identify and mitigate potential hazards. Secure loose cords, cover electrical outlets, and remove toxic plants or substances that could harm your pet. By making your home pet-friendly and hazard-free, you can minimize the likelihood of injuries or damages that may affect your insurance coverage.

Choosing the Right Home Insurance Policy for Pet Owners

When selecting a home insurance policy as a pet owner, it’s essential to consider factors that relate to your specific needs and risks associated with your pet. Here are some key considerations to keep in mind when choosing the right insurance coverage:

Pet-Friendly Insurance Companies

Some insurance companies are more pet-friendly and have experience dealing with pet-related claims. Research insurance companies that have a positive track record of working with pet owners and providing comprehensive coverage for pet-related incidents. By choosing a pet-friendly insurance company, you can ensure that your furry companion is well-protected under your policy.

Comprehensive Liability Coverage

Look for home insurance policies that offer comprehensive liability coverage for pet-related incidents. Ensure that your policy covers damages caused by your pet to others’ property, as well as bodily injuries resulting from pet bites or accidents. Having sufficient liability coverage can safeguard you against potential financial losses and legal expenses in case of unforeseen events involving your pet.

Specialized Pet Insurance Riders

Some insurance companies offer specialized pet insurance riders that can be added to your home insurance policy for additional coverage. These riders may provide benefits such as coverage for veterinary expenses, liability protection for pet-specific incidents, and reimbursement for damages caused by your pet. Consider adding a pet insurance rider to your policy to enhance your coverage and address your pet’s unique needs.

Review Policy Exclusions and Endorsements

Before finalizing your home insurance policy, carefully review any exclusions and endorsements that may impact coverage for pet-related incidents. Pay attention to specific breeds or types of pets that are excluded from coverage, as well as any endorsements that can enhance or restrict your policy terms. Understanding these details can help you make an informed decision and ensure that your pet is adequately protected under your insurance policy.

Conclusion

Pets can bring joy, companionship, and love to our homes, but they also come with responsibilities and risks that need to be managed effectively. By understanding how pets can impact your home insurance coverage and taking proactive steps to mitigate risks, you can protect your furry friends and safeguard your financial well-being. Remember to review your home insurance policy regularly, update it as needed, and choose the right coverage options to ensure that your pets are well-cared for and supported under your insurance policy. With the right knowledge and preparation, you can enjoy the company of your pets while maintaining peace of mind knowing that they are protected under your home insurance policy.